If you’re considering applying for a loan with Earnest, it’s important to understand their minimum credit score requirement. Earnest is a leading financial company specializing in private student loans and student loan refinancing. They offer competitive rates and flexible repayment options for borrowers, making them an attractive option for those seeking financial assistance for their education.

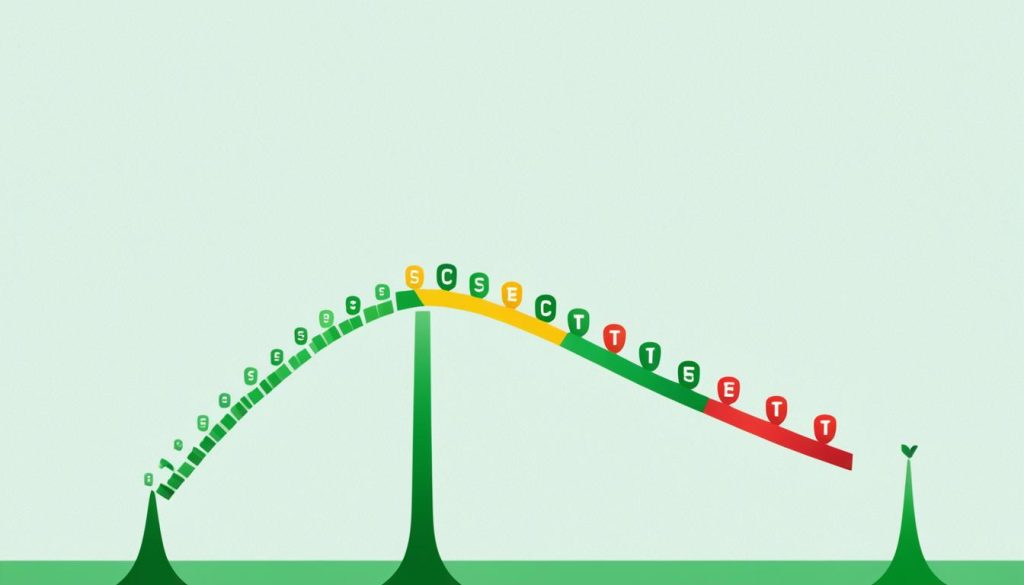

To qualify for an Earnest loan, applicants must meet a minimum credit score requirement. While the specific minimum credit score is not disclosed on their website, it’s crucial for potential borrowers to have a credit score of at least 650 to increase their chances of approval. Having a higher credit score may also result in better interest rates and loan terms, further enhancing the financial benefits of an Earnest loan.

Key Takeaways:

- Earnest has a minimum credit score requirement for loan approval.

- A credit score of at least 650 increases the chances of approval.

- A higher credit score may result in better interest rates and loan terms.

- Meeting the minimum credit score requirement is essential for unlocking financial opportunities with Earnest.

- Understanding the credit requirements is crucial for borrowers considering an Earnest loan.

Understanding the Earnest Loan Application Process

The loan application process with Earnest is simple and straightforward. To check eligibility, potential borrowers can complete a quick online application that does not impact their credit score. During the application process, Earnest will review the applicant’s credit history, debt-to-income ratio, and income to determine their eligibility for a loan.

While a specific credit score requirement is not mentioned, it is important for borrowers to have a credit score of at least 650 to increase their chances of approval. Meeting the minimum credit score requirement is just one aspect of the overall eligibility criteria for an Earnest loan.

The Benefits of a Cosigner for Earnest Loans

Having a cosigner for an Earnest loan can provide several benefits for borrowers. A cosigner is a person who signs the loan agreement along with the borrower and is equally responsible for repaying the loan. By having a cosigner with a higher credit score and a longer credit history, borrowers can increase their chances of approval for a loan and may even qualify for lower interest rates.

A cosigner acts as additional security for the lender, reducing the risk associated with the loan. Lenders rely on the cosigner’s creditworthiness to assess the overall repayment ability of the borrower. Therefore, having a cosigner with a strong credit history and qualifying credit score for Earnest loans enhances the borrower’s credibility and improves their chances of loan approval.

When a borrower’s credit score does not meet the minimum credit score required for an Earnest loan, having a cosigner with a higher credit score can compensate for this. It demonstrates to the lender that the applicant has a reliable source of repayment and is more likely to honor their financial obligations.

In addition to increasing the likelihood of approval, having a cosigner with a higher credit score can also result in lower interest rates for the borrower. Lenders often provide better loan terms and interest rates to borrowers with stronger credit profiles. As a cosigner with a higher credit score adds an extra layer of security, lenders may be more inclined to offer favorable rates and terms.

“Having a cosigner can make a significant difference in getting approved for an Earnest loan. It not only boosts the chances of approval but also opens doors to better interest rates and loan terms.” – Financial Expert

What credit score is needed for an Earnest loan?

While the specific credit score required for an Earnest loan is not explicitly stated on their website, it is generally recommended for borrowers to have a credit score of at least 650 to increase their chances of approval. However, meeting the minimum credit score requirement is just one factor in the overall loan eligibility criteria.

The Importance of Meeting Earnest’s Credit Score Requirement

Meeting the minimum credit score requirement is crucial as it demonstrates financial responsibility and a history of managing credit effectively. Alongside credit score, other factors such as income, debt-to-income ratio, and employment history also play a vital role in loan approval.

By carefully considering the benefits of having a cosigner and aiming for a qualifying credit score for Earnest loans, borrowers can enhance their loan application and increase the likelihood of securing the financing they need for their academic pursuits.

Federal Student Loans Vs. Earnest Loans

When it comes to financing college education, there are different options available, including federal student loans and private loans like Earnest loans. Understanding the differences between these two types of loans is crucial for borrowers to make an informed decision. One key distinction between federal student loans and Earnest loans is their approach to credit requirements.

Federal student loans do not take credit history or score into account when determining eligibility. This means that all eligible students can access federal student loans, regardless of their credit background. Whether you have a low or high credit score, federal student loans offer an opportunity to finance your education.

On the other hand, Earnest loans are private student loans that do consider an applicant’s creditworthiness during the loan approval process. While Earnest does not disclose a specific minimum credit score requirement, having a higher credit score can increase your chances of approval and may result in more favorable interest rates and loan terms.

By taking into account an applicant’s credit history and score, Earnest aims to assess their ability to repay the loan. This credit-based approach helps both the lender and borrower to evaluate the potential risk involved and ensure responsible lending.

To better understand the credit requirements for Earnest loans, it is recommended for borrowers to have a credit score of at least 650. However, meeting the minimum credit score requirement is just one aspect of the overall eligibility criteria for an Earnest loan. Factors such as income, debt-to-income ratio, and other eligibility requirements are taken into consideration as well.

Both federal student loans and Earnest loans can be valuable options for financing your education, but they cater to different circumstances. Federal student loans provide accessibility to all eligible students, regardless of credit history, while Earnest loans offer competitive rates and repayment flexibility for those with a stronger credit profile.

In summary, when considering your student loan options, it is important to weigh the benefits and considerations of federal student loans and Earnest loans. While federal student loans prioritize accessibility, Earnest loans provide more tailored loan terms based on creditworthiness. Assess your financial situation and goals to choose the loan option that is the best fit for you.

Repayment Plans and Options with Earnest Loans

Earnest offers a range of repayment plans and options to accommodate the diverse financial needs of borrowers.

Deferred Payments

One popular option is deferred payments, which allows borrowers to postpone making any payments while they are in school or for a certain period after graduation. This alleviates immediate financial burdens and provides flexibility during the transition from student to professional life.

Fixed Payment Plans

Another option is the fixed payment plan, where borrowers make consistent monthly payments while still in school. This allows for better budgeting and ensures that the loan is steadily paid down, reducing the overall interest accrued over time.

Variable Payment Plans

Earnest also offers variable payment plans, where borrowers make interest-only payments while enrolled in school. This lower monthly payment option provides immediate relief, especially for those who are facing financial constraints during their studies.

Deferment and Forbearance Options

Earnest understands that life circumstances can change, leading to temporary financial hardships. To support borrowers during these times, they offer deferment and forbearance options. Whether the need arises from returning to grad school, military service, or experiencing financial difficulties, Earnest is committed to providing assistance and flexibility.

Choosing the right repayment plan is crucial to meet individual financial needs and circumstances. By considering options such as deferred payments, fixed payment plans, and variable payment plans, borrowers can find an Earnest loan solution that aligns with their goals and eases the burden of student debt.

Conclusion

Understanding the Earnest minimum credit score requirement is essential for anyone considering applying for an Earnest loan. While the specific minimum credit score is not disclosed, it is important for borrowers to have a credit score of at least 650 to increase their chances of approval. Having a higher credit score can also result in better interest rates and loan terms.

However, it is important to note that meeting the minimum credit score requirement is just one aspect of the overall eligibility criteria. Borrowers should also consider factors such as income, debt-to-income ratio, and other eligibility criteria when applying for an Earnest loan. By understanding and meeting the necessary requirements, borrowers can unlock financial opportunities and achieve their goals with the help of Earnest.

Applying for an Earnest loan is a straightforward process. Potential borrowers can navigate through the Earnest loan application process by completing a quick online application that does not impact their credit score. Earnest considers factors such as credit history, debt-to-income ratio, and income to determine eligibility for a loan.

With competitive rates, flexible repayment options, and the potential to improve creditworthiness, Earnest loans provide a valuable financial resource for those seeking to fund their education or refinance existing student loans. By understanding the Earnest loan application process and eligibility criteria, individuals can confidently apply for a loan with Earnest, knowing they are taking a step towards their financial goals.

No comments! Be the first commenter?